How Businesses Can Benefit from Company Secretary Services?

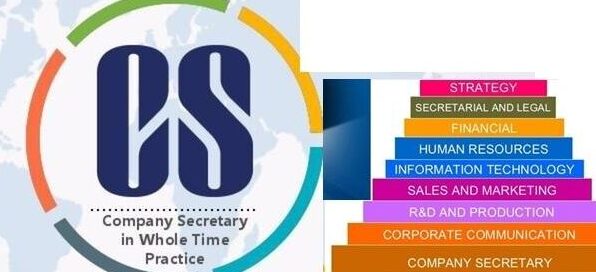

In modern business, the Company Secretary (CS) emerges as a strategic partner, guiding businesses from inception to sustained success. CS […]

How Businesses Can Benefit from Company Secretary Services? Read More »