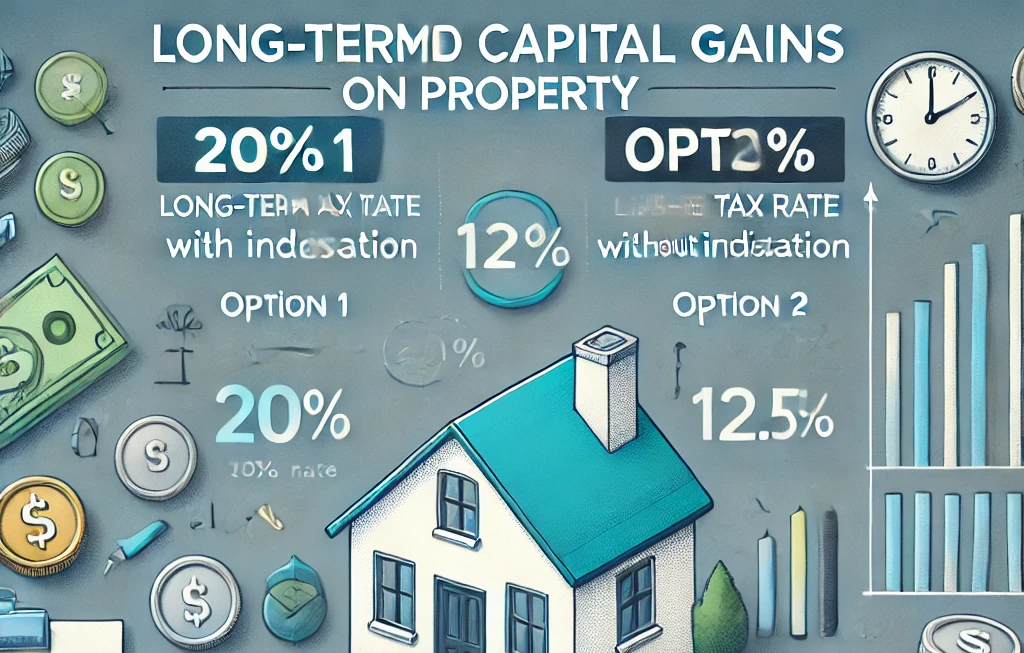

Maximize Your Gains: New LTCG Indexation Rules for Property Sales

Reintroduction of Cost Inflation Index on Long-Term Capital Gains for Property The Union Government’s Finance Budget for 2024 introduced several important changes in the tax

Reintroduction of Cost Inflation Index on Long-Term Capital Gains for Property The Union Government’s Finance Budget for 2024 introduced several important changes in the tax

What is HUF? HUF, or Hindu Undivided Family, is a legal entity in India that enables families to pool assets and avail tax benefits. By

Choosing the more tax-save regime can significantly impact your final tax payable. In India, you have the option to select at the time of your

The Finance Act, 2024, has introduced a new Tax Deducted at Source (TDS) rate for the financial year 2024-25 (from April 1, 2024, to March

Building a strong business? Don’t forget to register your trademark. In the busy hub of Bangalore’s business landscape, ensuring the protection of your business brand

For any new business, navigating the difficulties of GST (Goods and Services Tax) filing can feel overwhelming. While GST streamlines various indirect taxes, adhering to

In modern business, the Company Secretary (CS) emerges as a strategic partner, guiding businesses from inception to sustained success. CS professionals play a pivotal role

In the practicality of business operations, especially for small and medium enterprises, navigating through tax obligations and audits can be difficult. The Indian Income Tax

Professional Help for Stress-Free Tax Season Filing income tax returns (ITRs) can be a difficult venture for business proprietors and individuals alike. For the duration

Nidhi means a treasure, where money has been borrowed from its Members by way of issuing Fixed Deposit (FD), RD, Savings accounts etc. In India, to

#17/2, 2nd floor, Kodigehalli Main Rd, near Chairman club, opp. to SRPC staff quarters, SahakarNagar, Bengaluru, Karnataka 560092

© Copyright 2025 All Rights Reserved at TEAM IN FILINGS