Reintroduction of Cost Inflation Index on Long-Term Capital Gains for Property

The Union Government’s Finance Budget for 2024 introduced several important changes in the tax rate on the sale and disposal of long-term gain (LTCG) properties. These changes aim to provide certain benefits to property owners and ensure that taxes are flexible systems. However, the fine print of these amendments highlights some important issues that every taxpayer should consider before making a property investment decision.

Key Changes Introduced

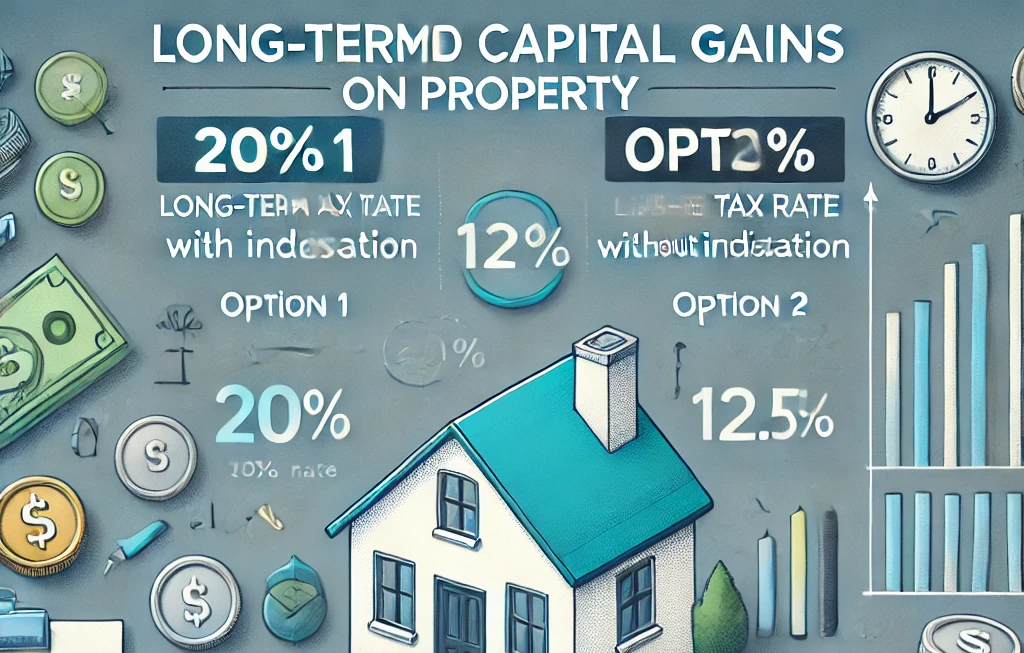

The Budget 2024 has reintroduced the option for taxpayers to choose between two different tax regimes when dealing with LTCG on properties purchased before July 23, 2023:

- Option 1: LTCG Tax with Indexation

- Tax Rate: 20%

- This option allows taxpayers to adjust the purchase price of their property to account for inflation, thereby potentially reducing the taxable gains. Indexation can significantly lower the tax liability, especially for properties held over a long period, where inflation might have substantially eroded the actual gain in real terms.

- Option 2: LTCG Tax without Indexation

- Tax Rate: 12.5%

- Under this option, taxpayers pay a lower tax rate of 12.5% but cannot adjust their gains for inflation. This regime may be more beneficial for those who have held their property for a shorter duration or where the inflationary impact is minimal.

Limited Availability of Indexation

Furthermore, the introduced benefits of the incremental cost index are not universal. As per the amendment, only resident individuals and Hindu Undivided Families (HUFs) are eligible for the indexation benefit. Notably, corporates and non-resident Indians (NRIs) are excluded from this scheme.

- Implications for NRIs and Companies: Exclusion of NRIs and corporations from indexation benefits means that these people have to opt for a 12.5% tax scheme that cannot be disclosed. This can result in higher tax bills for these entities, especially in the case of gifted assets.

- Possible modification: Industry experts including board advocates, secretaries and chartered accountants (CAs) indicate that this exemption may be oversight or intentional for specific reasons. But they are advocating for a final amendment to include immigration to ensure that all classes of taxpayers are treated fairly.

Loss Set-Off Not Permitted

Another critical aspect of the reintroduced indexation is that losses incurred under this regime cannot be set off against other gains. The indexation benefit is applicable only for calculating gains, and if the indexed cost results in a loss, such loss cannot be carried forward or set off against other gains.

Example for Clarity:

Consider Mr. A, who bought a house in 2015 for ₹50 lakh and sold it in August 2024 for ₹70 lakh.

- With Indexation (Option 1):

- Indexed Cost: ₹71.45 lakh

- Capital Loss: ₹1.45 lakh

- Tax Payable: None (as the result is a loss)

- Note: The loss of ₹1.45 lakh cannot be carried forward or set off against other income.

- Without Indexation (Option 2):

- Sale Consideration: ₹70 lakh

- Capital Gain: ₹20 lakh

- Tax Payable: ₹2.5 lakh at 12.5%

In Mr. A’s case, although he incurs a loss with indexation, this loss cannot be used to offset other income, leading to a scenario where he might opt for the indexation benefit solely to avoid paying tax under the new regime.

Maximizing Tax Savings on LTCG Using the 2024 Reintroduced Indexation

To maximize tax savings under the reintroduced LTCG rules, investors need to carefully consider the specifics of their property transactions.

NRIs

- Scenario: Since NRIs and companies cannot use the indexation benefit, they must pay tax at the 12.5% rate without indexation.

- Tax Strategy: For NRIs and companies, it’s crucial to strategically plan the timing of their property sale, ideally during periods of lower market volatility or when minimal appreciation has occurred. They should also explore other deductions or exemptions available under the Income Tax Act to offset their tax liability.

Alternate way for Reducing TDS on Property Sales

One of the most effective ways to substantially reduce the income tax on sale of property is to obtain a low TDS rate certificate from the Income Tax Department. This certificate allows NRIs and other eligible taxpayers to claim a reduced rate of TDS on the sale of their property, and ensures that a fraction of the sale proceeds is withheld as getting a lower tax TDS rate reduces income subject to the immediate impact, and avoids reversals of potential cash flow delays.

Team IN Filings specializes in helping clients including NRIs to obtain these lower TDS rate certificates. Our expert guidance will enable you to navigate the application process smoothly and ensure that you take advantage of tax reductions at source, and make significant savings in your property transactions. Contact us to learn how this service can help you improve your tax position and increase your income from the sale of property.

Final word

The reintroduction of indexation in the Finance Budget 2024 provides flexibility to property owners by allowing them to choose the tax regime that best suits their financial situation. However, the limitations on the availability of indexation and the inability to set off losses highlight the importance of careful tax planning.

Resident individuals and HUFs can benefit from indexation if their property has been held for a significant period, while NRIs and companies must navigate the new regime without this benefit. As the legislative process progresses, stakeholders are hopeful that further amendments will address the concerns raised by these exclusions, potentially making the regime more inclusive.