Steps to Register a Partnership

A partnership occurs between 2 or more parties Orally* or with a written agreement of the partners business, for more about what is Firm, pls visit here.

Where he can form the Partnership firm?

In Bangalore, the partnership firm registration process begins with Registration of firms @ Kaveri online services

Partners must have the following details to create a perfect partnership deed:

Agreement clauses (In Partnership Deed) –

- Name and address of firm and partners & No of Partners

- Nature of Business & Place of Business

- Capital contribution & Profit and loss sharing Ratio

- Duties, Responsibilities and Authority of each partner

- Terms and conditions for Admission, retirement and death of partner

- Dispute resolution: In case of dispute among the partners, it can be resolved by mutual discussions or Appoint an Arbitrator*.

- Other Business specific terms and conditions

- Signature of partners and witnesses.

The Partnership deed must be drafted under the guidance of experienced professionals like Prakasha And Co, so that it is perfectly legally binding and does not miss any important details. So, Team IN Filings could help you with Partnership deed as well as the registration process without any hassle:

Contact Us

For making good partnership firm registration or related queries, feel free to reach out to Team IN Filings, Bangalore, your trusted tax and compliance partner.

📧 Email: team@teamindia.co.in

📞 Phone: +91-7019827351

📍 Location: Sahakarnagar Bangalore, Karnataka

Let us handle the firm complexities so you can focus on your financial goals.

Firm Required Documents

For registration of a partnership firm in Karnataka, the following documents are required:

- Partnership Deed: Must stipulate the terms of partnership and must be signed by all partners an e-stamp of Rs.2000.

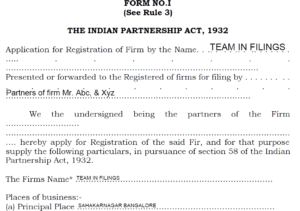

- Application Form: Application Form (Form-1) is available at Registrar of Firms‘ office or online and the forms must contain: Name of the firm; Nature of business; Address.

- Affidavit: Sworn declaration that the firm is complying with certain provisions of the Partnership Act 1932.

- PAN Card: Requires copies for the partners of the firm along with any 1 ID proof.

- Proof of Business Address: Documents such as rental agreements, utility bills, or ownership documents concerning the business premises.

Partnership registration process (in Karnataka):

For example, If ABC and XYZ want to commence a partnership firm, then the following are the steps that they need to follow:

Step 1: They need to make sure that the objective of their business is considered legal in the eyes of law.

Step 2: Once both of the parties are agreeing to enter into partnership, they need to accept there mutually agreed business terms and conditions as per the partnership deed.

The partnership deed is a legal document, which includes the terms and conditions under which the parties have come together to form a partnership. It must cover the following:

- Name of the Firm,

- Addresses place of the firm.

- Name, father name and addresses of all partners.

- Capital contribution by each.

- Profit-sharing ratios.

- Roles, duties, responsibilities of each partner.

- Any special power with any partner to be specified

- Clauses for dispute resolution, admission or retirement of partners, and dissolution of the firm.

Step 3: Now ABC and XYZ need to notarize the deed by a public notary and also sign the deed (by all partners) in the presence of the notary.

Step 4: Next, they have to collect/download Form 1 Application for Registration of a Partnership Firm from Karnataka Registrar of Firms. The details required in this include-

- Name of the firm and its address.

- Names and addresses of each partner.

- Nature of the business.

- The date when the partnership firm was established.

- And an Attachment of a covering letter to the Registrar of Firms along with the application form.

Step 5: To get the smooth registration, they must collect all the required documents required like:

- Notarized Partnership Deed (Original + Copy)

- Form 1 (duly filled and signed by all partners)

- Affidavit: Declaration that Indian Partnership Act is being complied

- Utilities: Rent agreement, utility bill, Ownership document.

- PAN & Aadar Cards of the partners.

- Passport-size photographs of all partners (if required by local guidelines).

Step 6: Once the registrar completes the process of verification, the registrar issues a certificate. The partners need to make sure that they collect this Certificate of Registration. By virtue of this certificate, the firm proves existence in a legal way and is entitled to use it for opening bank accounts or to seek licenses.

Partnership firm Registration Expenses:

- Registration Fees – Rs. 2000*

- Stamp Duty – Rs. 2000*(it varies based on capital)

- Professional Fees – Rs. 1500 to Rs. 5000 (it is applicable in case you hire a professional or any consultant to assist).

FAQ on the partner’s Firm:

How much salary can draw as partner of the business?

The maximum amount of salary, bonus, commission or other remuneration to all the partners during the previous year should not exceed the limits given below:

- On first 3 lakhs of book profit or in case of loss – ₹ 1, 50,000 or 90% of book profits (whichever is higher).

- On the balance book profit 60% of book profit.

Update on Allowable Remuneration for Partnership and LLPs under Section 40(b):

Earlier Provisions: Previously, the calculation of allowable remuneration under Section 40(b) was as follows:

- If Book Profit was Negative or Zero: No remuneration was allowed.

- If Book Profit was Positive: On the First ₹3 Lakhs of Book Profit: 90% or ₹1,50,000 (whichever was higher). On the Balance Book Profit: 60%.

Revised Provisions (Current): The new regulations for calculating allowable remuneration under Section 40(b) are:

- If Book Profit is Negative: Remuneration up to ₹3,00,000 is allowable.

- If Book Profit is Positive: On the First ₹6 Lakhs of Book Profit: Higher of ₹3,00,000 or 90% of the book profit. On the Balance Book Profit: 60%.

This change broadens the scope for allowable salary to partners, especially benefiting firms with negative or low book profits. For further clarification or assistance, feel free to reach out to Team IN filings Prakasha & Co., Bangalore.

Difference between Registered and Unregistered Partnership Firm:

| BASIS | REGISTERED FIRM | UNREGISTERED FIRM |

| Legal Recognition | Once a firm is registered, it is legally recognised as a lawful entity. | An unregistered firm runs informally without any legal recognition. |

| Ability to Sue | The registered firms have the right to sue third party and be sued. | The unregistered firm does not have any right to the third party. |

| Conversion | It is easier to convert registered partnership into an LLP. | To convert into an LLP these firms need to register first. |

Challenges faced while registration:

- Selecting a name which is appropriate: The seeking the name does not infringe or resemble other entities which are already registered. There are legal requirements as well as cultural sensitivities which should be complied so that it does not undergo rejection.

- Proof of business premise: If the business is in initial stage, it would be challenging for them to immediately arrange for a place of business and be able to provide the required rent (as rental agreement is a vital agreement).

- Stamp Duty: Stamp duty can be costly, only if the partnership firm has a large amount of capital (as it depends on the firm’s capital). For small businesses, the cost of stamp duty can be burdening.

- Taxes and Licenses: It is possible that additional registrations might be acquired by the firms such as GST and professional tax or even specific business license requirements like FSSAI for restaurants and BBMP license for trade in Bangalore etc.

- Feeling of legal compliance: Compliance with local and even national regulations can be baffling. In India, compliance with laws such as the Partnership Act of 1932 may involve legal knowledge, consulting an experienced professional like us would be advised in this situation.

Do’s in Registration of a Partnership Firm

- Detailed Partnership Deed: This would have clauses regarding sharing profits, duties of the partners, admission and exit procedures, disputes and their resolution, and dissolution.

- Choose a Unique Name: Ensure that there is no duplication of the name by reference to the relevant trademark and businesses registries. To know more about the trade-mark refer to the following link. effective Trademark

- Comply with Documentation Requirements: Provide the said documents, which are relevant proofs like; ID and address proofs of partners, Registered office address proof & Stamped and notarized partnership deed.

- Pay Appropriate Stamp Duty: Have the deed stamped in accordance with the requirements of the local authorities.

- Consult an experienced Professional: Ensure that assistance is provided by a lawyer or chartered accountant to avert legal and procedural problems.

Don’ts in Registration of a Partnership Firm.

- Avoid Ambiguity in the Deed: Uncertainties can create conflicts in the future.

- Don’t Use a Prohibited Name: Avoid using names that give the impression that the government stands behind the enterprise or are judicially obnoxious.

- Don’t Submit Incorrect Information: Providing false or contradictory information in the application can cause this application to be denied and, in some instances, bring about legal problems.

- Incomplete Documentation: Make sure to provide all the mentioned documents in the right format.

- Deed Drafting: The Partnership deed must be drafted under the guidance of an experienced professionals so that it is legally binding and does not miss any important details.

FAQs

Q1: Can I start a partnership without registration?

Answer: Yes, partnerships can be unregistered, but registering your partnership gives it legal recognition, it provides liability protection, and is essential for opening a bank account and complying with tax laws. We Prakasha And Co recommend registered Firm always good for the each partners of the business.

Q2: Do I need a partnership deed for registration?

Answer: While not mandatory for unregistered partnerships, a partnership deed is critical for registered ones to clarify the rights and obligations of partners, share of profit, dispute resolution, etc.

Q3: Can a foreigner be a partner in an Indian partnership?

Answer: Yes, foreign nationals can join an Indian partnership, but compliance with RBI regulations and other legal frameworks must be considered.

Q4: What if one partner wants to leave the partnership?

Answer: In this scenario, within 6 months a new partner must join the firm (in case of only 2 parties involved in the partnership). The partnership deed typically contains clauses that outline the exit procedure, asset distribution, and settling of liabilities.

Q5: What are the tax implications for partnerships?

Answer: Partnership firms are taxed after partnership firm pays the salary to partners and other business expenses at 30% (for individual partners, the tax is based on there individual income level), and GST registration is required if annual turnover exceeds the prescribed threshold (refer to the following link to know more about GST Registration).

Q6: What are the other registrations that the firm might need to obtain?

Answer:

- GST Registration (if the firm exceeds the threshold limit of 20 Lakh)

- FSSAI: A firm would need to register under Food Safety and Standards Authority of India (FSSAI) if they run any food-related business like a restaurant.

- BBMP: Every partnership firm doing business in Bangalore needs to apply for the Bruhat Begaluru Mahanagara Palike (BBMP) License.

Q7: How to amend the partnerships if any changes after registered?

Answer: Once the partnership firm Certificate has been received, then you have to reconstitute the partnership deed by making amended partnership deed and submit the required documents to registrar for update.

Q8: In a firm if any goal-mall happens, who is responsible for that?

Answer: all partners are responsible though anyone did any fraud or goal-mall in the firm, this has the exception under Limited Liability Partnership firm (LLP), under LLP only that partner who committed fraud or cheating or goal-mall he only held responsible but not others. for Registration of LLP, you can visit here LLP registration Bangalore

*Oral Partnership: An oral partnership refers to a legal agreement between 2 or more parties to conduct business without any written contract, purely based on mutual trust.

*Arbitration: If dispute is unresolved mutually then the matter could be referred to arbitration. This includes appointing an arbitrator, location of arbitrator and the binding nature of the decision. This ensures that they do not need to go through lengthy court proceedings.

The above blog has been articulated with support from Sr. Team IN Filings & Ms. N Janani & Mr. Mayavan MA

Get your Partnership Firm Registration completed within 7 days with Team IN Filings. Enjoy a hassle-free, legally binding process and complete peace of mind to kickstart your business.

Visit us at Sahakarnagar, Bangalore – 560092,

call 07019827351, or

email team@teamindia.co.in today!