GST Scrutiny Notice

What is a Scrutiny under GST?

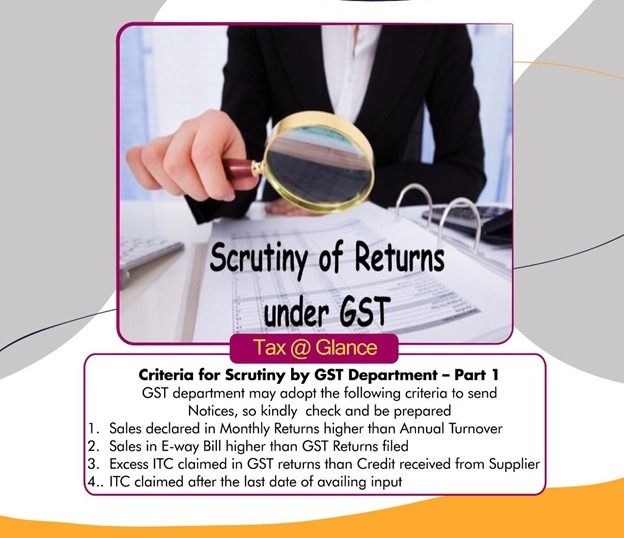

A GST officer will thoroughly check the GST returns of the selected taxpayer based on certain risk parameters, to verify its correctness.

If he finds any mismatch or errors, he will issue a scrutiny notice to the taxpayer demanding an explanation.

Types of risk parameters under GST Section 61:

- Sales declared in Monthly returns is Higher than Annual Return.

- Sales in E-Way bill higher then GST Returns Filed

- Excess input credit (ITC) claimed then actual credit received from Suppliers

- Input (ITC) claimed after the last date of availing input

Types of errors under GST

- GSTR 2 A showing purchase details, but no sales outward appearing

- Net Gst payable NIL or Zero throughout the year.

- Turnover in GSTR 1 and 3 B mismatch

- Regular amendment in the invoices, but no GST payment found

External Information for GST scrutiny:

- Turnover reported as “Exports” billed in foreign currency or not

- Balance sheet shows “Other Income” but no turnover declared in GST return

- Nil e-way generated throughout the year

Your jurisdictional GST officer, as per procedure issue a notice, informing about such errors, mismatch.

If you’re agree on the demand, then make the GST payment (form DRC-03) with interest along with other amount arising from such errors. then inform the same to GST officer.

How to respond to GST Scrutiny notice?

- Verify the correctness of the notice with books and return filed.

- If you are agreed on the notice demand; make the GST payment.

- Any excess input credit (ITC) availed, reverse the ITC and make the difference payment

- File the Replies to Notice within 30 days of receipt.

- The response from you is satisfactory to GST, he will drop the proceedings

- If the GST officer is un-satisfied, he will issue an order with demand

Consequences of not responding to a GST Scrutiny notice

- Initiate the department Audit and special Audit if required

- Ask for produce of all books of accounts,

- Ask for produce the Audited Balance sheet, profit and loss statement

- Ask for reconciliation report

As the GST law has been introduced recently; many business may not properly reconciled there books with GST returns, this would lead to mismatch with books and returns filed.

Hence, we strongly advise to keep proper reconciliation with books of accounts, GST filing, input credit etc.

for more information and assistance about GST matter, reach us at

Team IN filings, #188, 1st Floor, Sahakarnagar

Bangalore, Karnataka-92, Email:Support@teamIndia.co.in

About Us

Team IN Filings is a Tax & Law house in Bengaluru specializing in company matters, income Tax Gst, Trademarks Startup India, etc.

Our expert company secretary, tax consultant, CA, and Trademark agent provide Taxation, Registration for Companies Accounts Audit, Legal compliance, etc.