Provident Fund

A PF is a saving and investment for employees, it serves as a retirement corpus to support an employee. A company needs to create a PF Registration to do file PF online every month.

Checklist while filing for PF Ecr

- Before uploading PF Ecr,

- a. Verify New Employees’ UAN Status:

- It is required to verify if the new employees’ UAN (Universal Account Number) has been registered previously under the company’s pf account.

- In the absence of registration of UAN, an employee will need to be assigned a new UAN.

- Update the Employee Master Data

- Joining Date – PAN

- Aadhaar Copy, Bank Account Number, Isfc Code

- Basic Monthly Salary

- Email and Phone Number

- UAN Cross Check:

- Employees’ Aadhaar, PAN, and UAN should be in sync with respect to the employees’ name, date of birth, and gender.

- In the event they do not sync, employees will have to themselves amend documents as necessary.

- PF Resignees Update:

- Change the status off the employees’ who have resourced within the master data.

- Ensure that the last working day of those employees is well captured onto the system.

- Monthly Salary Data Validation:

- Ensure that the PF Members’ basic salary of each individual for the current month has been followed up with that salary of the preceding month.

- Ensure that any adjustments in respect thereof or in respect of the salary or deductions were made.

- Ensuring All Input Data is Aligned with Intended Deposition:

- Surveillance that new joinees and resigners are correctly represented in the PF master data.

- Double check correctness of employee’s details in order to prevent issues in the creation of UANs or the filing of PFs.

Step-By-Step Process of PF Filing:

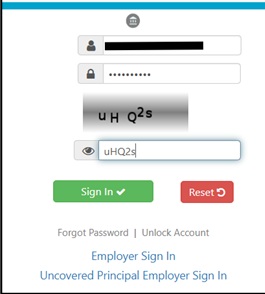

- Proceed to ECR Upload Section: Using your credentials, log in to the Employer’s Provident Fund (EPF) page. Proceed to the section for uploading ECR files. There are normally under “Payments” or “ECR filing”.

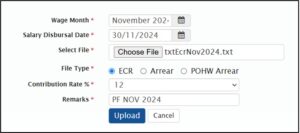

- Prepare and Upload the ECR File: You may also make use of a monthly payroll system to manually:

- Create and upload the ECR file trigger (usually a .txt file):

- Ensure it has the following information:

- UAN (Universal Account Number) of employees.

- Employee and employer PF contributions.

- Wages and other necessary details. Wages/ Income, and other relevant information.

- Use validation tools from EPFIGE tools to check if it is fit to be submitted. In the ECR Upload section, browse and select the prepared ECR file. Submit it for validation.

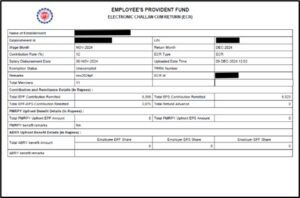

- Now, confirm that the ECR Data Uploaded is Indeed Correct: Once you have uploaded the ECR, then confirm the data that is being portrayed on the screen.

- The total number of employees.

- The total wages.

- The number of contributions (employee and employer).

- The number of subordinates and day’s work.

-

Make Payment for PF Contribution:

- After re-evaluating and confirming the ECR data, the system wealth is set against right for the Contribution amount. Challan comes into the picture here.

- Record the particulars attached in the Challan further listed Pay using any of the specified payment methods offered into the gateway or use net.

- Download Acknowledgment/Challen: When the payment has been completed, a copy of the receipt or the Challan can be printed or saved. This receipt is required to be maintained as evidence of payment made.

- Reconcile and Confirm the Wages/Salary: In addition, ensure that the details of the Challan correspond to your pay sheet. In case of any changes or amendments, please make sure that they are appropriately recorded.

- Create Periodic Reports on Compliance Status: Extract details from the ECR file and payment records to prepare compliance reports. These reports are useful in both internal and external audit exercises and in meeting legal obligations.

- Incorporate the Changes in the Existing UAN: In case there is a change in any particulars of the employees (like name, date of birth, contact numbers, etc.,), it should be updated there under the concerned employee’s UAN.

- Locate the “UAN Update” section in the EPF website.

- Provide the amendments required and documents if any are added where necessary.

- After this change, the employee can proceed to from this step to the next step and then the last step once changes are approved from EPFO.

Checklist for Amendments in Employees’ PF Information

- Employed Details Modification Without Failing to Verify Employee KYC Document

- Verify Managers updates needed in regard to existing employees. For instance, managers:

- In case of Name Mismatch in Bank

- Bank Particulars

- PAN change

- Verify Managers updates needed in regard to existing employees. For instance, managers:

- Joint Declaration for older updates

- For changes more than 6 months ago,

- Prepare a Joint Declaration Letter signed by both the employee and employer.

- Attach self-attested copies of the employee’s PAN and Aadhaar.

- Submit the documents to the nearest PF office where the account is maintained.

- For changes more than 6 months ago,

- Joint Declaration applicability:

- PF Exit Date Correction:

- Responsible person must determine whether there was a need to amend retiring date of PF account held with other employer.

- If so, Kindly do so by submitting Joint Declaration Letter to PF Office.

- PF Exit Date Correction:

- At the time of PF Transfer Between UANs:

- Ensure automatic transfer of PF balances when an employee switches jobs.

- If there is delay in automatic transfer-

- Guide the employee to login into their personal UAN portal with UAN Credentials.

- use the reset option

- Update and initiate the transfer request from the employee’s login

- KYC Updates by Employees

- Inform employees to update their KYC (e.g., PAN, Aadhaar, Bank Details) directly through their UAN login.

Ensure all information is accurate to avoid further mismatches or errors.

The current Company shall approve the basic KYC update using Director’s DSC.

Benefits of PF for the Employees

- Retirement Savings: Provides a secure savings fund for employees to use after retirement, ensuring financial independence in later years.

- Tax Benefits: Employee contributions to PF (up to ₹1.5 lakh per year) are eligible for tax deduction under Section 80C of the Income Tax Act. The interest earned and maturity proceeds are tax-free if the account is held for 5 years or more.

- Life Insurance Coverage: Through the EDLI (Employees’ Deposit Linked Insurance) scheme, employees are automatically entitled to life insurance coverage without additional premium costs.

- Partial Withdrawals for Emergencies: Employees can make partial withdrawals for specific needs like medical emergencies, higher education, marriage, or purchasing a home.

- Pension Benefits: A portion of the employer’s contribution is allocated to the Employee Pension Scheme (EPS), ensuring a monthly pension post-retirement.

Tax Benefits and Implications in PF

- Tax Benefits on Contributions:

- Employee Contribution: Tax deduction under Section 80C in the Income Tax Act for maximum Rs.1.5 lakh per year.

- Employer Contribution: Tax-free for the employee if it does not exceed 12% of his basic salary; above that, the contribution is treated as taxable income.

- Tax-Free Interest: Interest on PF is tax-free as long as the employee’s annual contribution does not exceed ₹2.5 lakhs. If the contributions are above INR 2.5 lakh (INR 5 lakh if the employer does not contribute), then interest is taxable on this amount.

- Tax on PF Withdrawal:

- Taxable if withdrawn before 5 years of continuous service. The employer’s contributions and earned interest will be taxed under the income from salary, while the employee’s contribution, if claimed under Section 80C of the Act, will be taxed under income from other sources.

- Tax-free after 5 years of continuous service, including contributions and interest.

- Partial Withdrawals : Withdrawals for certain purposes such as medical emergencies, education or acquiring a house will be free of tax subject to conditions of EPFO.

Monthly Problems in PF ECR Submission

- ECR File Structure problem:

- There is a need to ensure that the ECR is prepared in the requisite CCR TXT file of the PF portal.

- Make sure the organization of the file is correct before it is uploaded so that it will not be rejected.

- 2. Employees in Employment Verification are More/Less than in Actual Employment:

- The number of employees in the ECR file submitted is constant with the number of employees input.

- Also, check if any employees are left out or more are included in the ECR data.

- 3. The PF Amount Due Receivable Amount Could Not Be Able to Determine:

- The total amount due for PF in ECR is equal to the amount calculated inside the working excel document.

- Contributions like admin charges for PF and EDLI are handled during the last reconciliation process.

- 4. Approvers for basic pf details of the employees such as children dependency which includes, age, birthyear, and marriage;

- Changes in basic pf detail such as user name to which credit is made and earlier, modification in the pf account.

- However, if a change is required, an employee must visit the PF office with self-attested Pan and Aadhar copies to manually change their records in case such details require modifying.

- 5. Last Working Date Not Updated by Previous Employer:

- Confusions arise if an Ex-employer doesn’t update the last working date of the employee due to:

- Company closure.

- Previous employer’s HR/payroll not helping out.

- Confusions arise if an Ex-employer doesn’t update the last working date of the employee due to:

- The Previous Company has no valid DSC for such changes to happen.

- Without this, PF transfer from old employer to the present account could not be started.

- 6. Steps to Resolve Last Working Date Issues:

- Former employee should approach the HR/Payroll/Accounts division of the earlier employer, in the first instance, to help her or him in updating the exit date.

- Permutations of Exit date (if the previous company has shut down & is untraceable)

- The employee is to approach the PF officer and submit a letter of undertaking, and certain relevant documents (appointment letter, relieving letter, and so forth).

- Ask for a manual change of the exit particulars.

Common Myths and Misconceptions in PF

- My PF Money is lost when I resign from service.

Myth: Most people think that when they go-out of an organization and do not move their PF balance then the money is lost.

Fact: It is not possible for PF money to get ‘lost’. The amount is deposited into the PF account and the respective employee earns a yearly interest on this amount. Inactive accounts however, stops earning any interest after 36 months of inactivity, but you may still reactivate the account or relocate the amount to a different account. - It takes decades to withdraw the PF money.

Myth: Some people think that the process of taking out cash from the PF account is time consuming and agonizing.

Fact: One more boon resulting from EPFO’s online services is that it is possible for members to file claims using the UAN portal or the UMANG app. As long as the KYC details corresponding to the member’s Aadhaar, PAN and the bank account are there on record withdrawal may take a few days. - You cannot withdraw PF before retirement.

Myth: There are people who believe that the money from the PF account can only be taken out after the reach retirement age which is 58 years.

Fact: A person who is a member of the Employees’ Provident Fund is allowed to withdraw the funds at any age subject to the conditions where the withdrawal is for the following purposes:

For medical needs.

b. For education and marriage purposes.

c. For purchase /construction of a home.

d. In addition, if someone has been out of work for more than two months then that person will also be able to withdraw their PF balance.

- My employer has authority over my Provident Fund balance.

Myth: A number of employees believe that their PF money can be controlled or prohibited by the employer in such a way that they cannot use it.

Fact: The money set up in the PF account is your asset. Employers do not limit removals or transfers. They only assist in making contributions. For conflicts, you may file a complaint to EPFO directly.

- I should not take concern about Universal Account Number when changing a job.

Myth: There are people who believe that when they change jobs their Provident Fund contributions follow them, and this is done whether they link their contributions with the Universal Account Number or not.

Fact: A universal account number also known as UAN, is central in enabling smooth transfers of funds from one PF account to the other. When changing your job, you need to transfer PF, which requires linking your UAN to Aadhaar and activating it.

Commonly faced issues on PF withdrawal:

1.Update KYC

- Unlinked/Unverified KYC: Your Aadhaar, PAN, or bank account may not be linked or verified with your UAN.

- Mismatch of Details: Minor mismatches of names or initials versus full names can cause problems. For Example; After marriage if Radha decides to change her name as Radha Krishnan, then she needs to login to the Pf members portal and send a request to the employer, once the employer gets the notification on their webpage, they will update the name. If Radha fails to inform her employer, then the problem of name being mismatched arises causing trouble at the time of withdrawal.

- Technical Errors on the Portal

- Portal Downtime: The PF portal, that is, EPFO in India, may have its downtime or experience glitches.

- Claim Rejection Brought About by Incomplete Information: Less-than-complete or inaccurate claim forms can lead to rejection.

- Aadhaar-OTP: If OTPs are not generated due to the failure of mobile numbers to link to Aadhaar, processing would then become impossible.

- Employment History Issues

- Claim Pending for Approval from Employer: There are some claims that are to be validated by the employer which can hold up the process.

- Claims Pending with Previous Employer: If the old employer has not marked your date of exit nor transferred the PF balance, any withdrawal s may get stuck.

- Multiple UANs: Multiple UANs would only make withdrawal cumbersome with respect to employment history without any consolidation.

- Tax and Compliance Issues

- Tax Deduction: Tax may apply to PF account withdrawals less than five years. If PAN is not updated, then there could be high TDS.

- Penalty for Early Withdrawal: A fine may sometimes be imposed by the government for prohibitive conditions of withdrawal.

- Documentation Problems

- Wrong Bank Account: Claim maybe not process due to bank particulars not correct or updated or verified.

- Missing or Outdated Records: Not having sufficient employer contribution records or incomplete detail within PF account can hinder withdraw.

FAQ on PF

Q1: What is a Universal Account Number (UAN), and its importance?

A: The UAN is a 12-digit number allocated to every employee who contributes to the EPF, this number is a unique identifier. It acts as an umbrella for multiple Member IDs assigned to an individual by different employers. The UAN allows the workers to manage their PF balances across employment, enabling them to transfer balances and make withdrawals with ease.

Q2: How much contribution is made to the PF account on a monthly basis?

A: The monthly contribution by both the employer and the employee to the PF account is 12 percent of the employee’s basic salary plus the dearness allowance. From the contribution of the employer which is 12%, 8.33 percent is remitted to the Employee Pension Scheme (EPS) and the balance of 3.67 percent is paid into the EPF account.

Q3: Can I withdraw the PF balance before reaching menopause?

A: Yes, partial withdrawal is allowed under specific conditions, such as:

- Medical emergencies.

- Marriage or higher education expenses.

- Purchasing or constructing a house.

- Loss of employment (after 2 months of unemployment).

Q4: How do I check my PF amount online?

A: You can check your PF balance through the following:

- Login to EPFO member portal with your UAN and password.

- Text the phrase “EPFOHO UAN” to the following number: 7738299899.

- Set up on the Umang App to check out your balance.

Q5. What happens if the employer fails to deposit PF on time?

A: Erasing or delaying the payment of PF, liabilities invite penalties, interest charge, and unfriendly legal positions. It is also within the powers of the EPFO to impose damages of between five percent to one hundred percent of the amount of contribution depending on how long it took the employer to settle his obligation.

Q6. How do employers generate UAN for new employees?

A: Companies are able to register a UAN to the new employees through the EPFO employers’ website after providing him or her with his/her Aadhaar number, PAN number, and bank account number information. If all the information provided is correct, the UAN is subsequently created on the spot.

Q7. If an employer is registered with EPFO and files ECR then does he require filing ECR every month separately?

A: Yes, each month, an ECR (Electronic Vouchers and Return) needs to be created and uploaded by the employers who must declare the contributions of their employees. This is to safeguard compliance and ensure that contributions of the employees are credited to their accounts in time.

Q8. How is the PF balance transferred to a different account when a person switches jobs?

A: The transfer of PF (provident fund) is automatic if the UAN is active and the member has completed the KYC process. In a situation where this is not applicable Tap on the ‘transfer request’ by clicking on the UAN Portal through ‘On line Services > One Member One EPF Account’.

Q9. Is it possible to not contribute to PF?

A: To those who have a basic pay of over ₹ 15,000, the threshold can be submitted n form 11 at the time when they commence their first employment. Yet, If you registered for PF contributions you would not be able to opt out of it.

Q10. Do I still have a PF account that I have not cashed out after retirement?

A: Your PF account will continue to accrue interest for up to three years. Subsequently, it will be categorized as dormant and cease to gain interest.

Q11. Can I withdraw amount from PF account at the time of unemployment?

A: Yes, withdrawing from PF account is possible at the time of unemployment. If the unemployment has been for a longer duration, then they can withdraw fully or else partial withdrawal after certain period is allowed. The steps for the same are given below:

- Log into the portal for PF: Either access the official Employees’ Provident Fund Organisation portal (in India) or the equivalent in your country.

- KYC Verification: Ensure your KYC details are updated and verified (Aadhar, PAN, and bank account).

- File a Claim Online: From the “Online Services” section, select “Claim (Form-31, 19 & 10C)”. Choose the type of withdrawal (partial or complete).

- Processing: Most of the claims take around 10 to 15 working days for processing.

- Disbursement: The approved funds will directly be credited to your bank account.

This article has been contributed by Ms. Janani N, with the help of Team IN Filings.

For professional support with PF filing, reach out to Team IN Filings, your trusted PF partner in Bangalore for all PF-related services.

for PF related Payroll process contact Prakasha And Co, banaglore leading Payroll service