Aug- 2021 Calendar

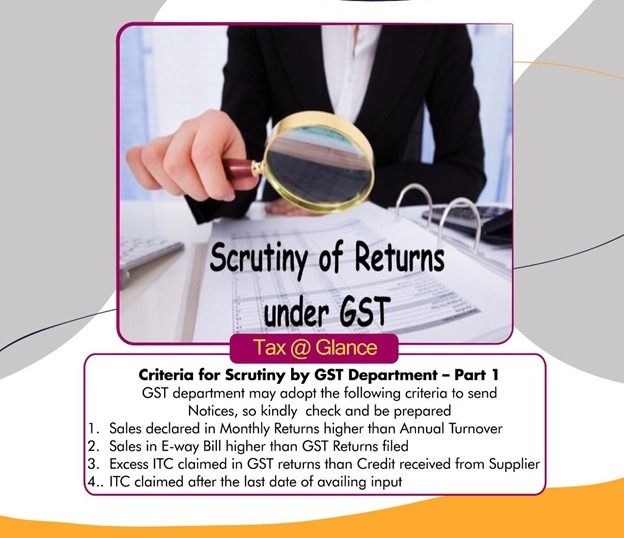

Aug- 2021 Calendar # Statue Purpose Compliance Period Extended Date Event Details 1 Income Tax TDS Liability Deposit Jul-21 07-Aug-21 Due date of depositing TDS/TCS liabilities for previous month. 2 GST Details of outward supply-IFF Jul-21 13-Aug-21 Invoice furnishing facility for July, 2021 is available for registered person with turnover less than INR 5 Crores […]

Aug- 2021 Calendar Read More »