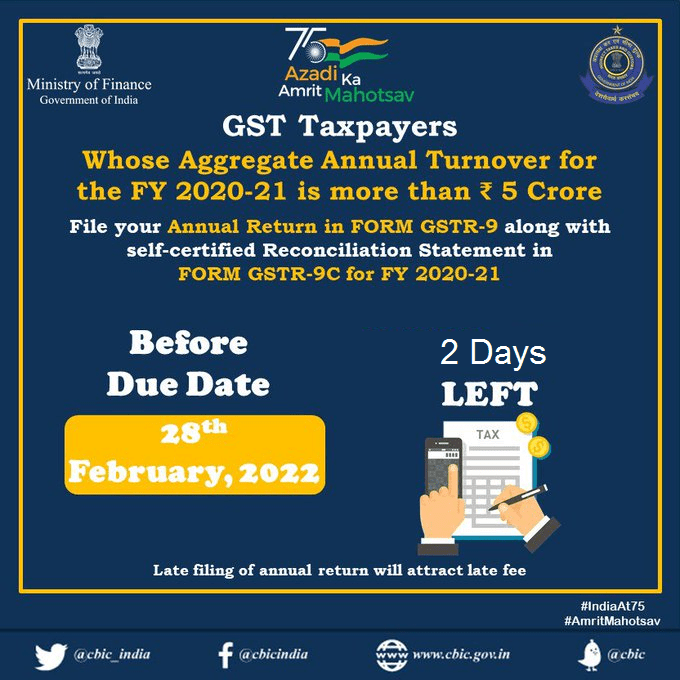

File your Gst return by 28 Feb 2022

Gst annual return FY 2020-21

Gst Annual return:

Gst Annual return is a summarized return to be filed at the end of the each financial year.

The form GSTR-9 shall be used to file annual return.

It is an annual compilation of outward supplies, inward supplies, tax liability and input tax credit availed during a financial year.

It’s a compulsory for the business, where the aggregate turnover is more then 2 Cr in a financial year.

Due date for furnishing annual return GSTR-9 & self-certified FORM GSTR-9C for the financial year 2020-21 is ending on 28 Feb 2022 (vide Notification No. 40/2021)

Changes in GSTR 9 and 9C FY 2020-21

The GSTR-9C was earlier applicable to businesses with more than Rs.2 Cr. required the audit of books and records of that year by a CA and their certification. These requirements are removed from the financial year 2020-21 onwards. Instead, Form GSTR-9C requires it to be self-certified by the assesse.

Major changes in GST Annual return:

Due date for filing annual return : 28 Feb 2022

Exempted Gst annual return Up-to 2 Cr turnover

Gst Audit and certification removed

Pay the Gst shortfall through Drc3

Gst’s annual return and turnover limit

Turnover (aggregate) up-to 2 Cr, not required (exempted)

2 Cr. To 5 Cr – Gstr 9 shall be filed.

More then 5 Cr – Gstr 9 and 9C shall be filed.

The Official handle of CBIC tweeted, “Attention GST Taxpayers whose Aggregate Annual Turnover for the FY 20-21 is more than Rs. 5 crore!

File your Annual Return in Form GSTR-9 along with self-certified Reconciliation statement in GSTR-9C before February 28, 2022.

For more about Gst annual return, pls, reach us at Team IN Filings

Our office Address

No. 188, 1st Floor, Sahakarnagar, Bengaluru – 560092

Tel: +91 7019 827 351 Email: team@teamIndia.co.in

WHY US

We help you right process at one place.

Team IN Filings, Bangalore’s Leading Tax and Law Firm, providing all Company Law, Income tax, Gst, Labor law, Export – Import, Trademark, Startup India etc. It is a professionally managed firm having a team of experienced Company Secretary, Chartered Accountant, Lawyer and Tax consultant to provide various services like Company Registration, Tax filing, Accounting, Trademark, Payroll, Audit, Roc filings, litigation and representation, transaction advisory & compliance

Get the Best Service

About Us

Team IN Filings is a Tax & Law house in Bengaluru specializing in company matters, income Tax Gst, Trademarks Startup India, etc.

Our expert company secretary, tax consultant, CA, and Trademark agent provide Taxation, Registration for Companies Accounts Audit, Legal compliance, etc.